Nigeria’s debt profile has ballooned to an alarming ₦149.39 trillion as of the first quarter of 2025, a development that experts warn could plunge the country into deeper fiscal instability if unchecked.

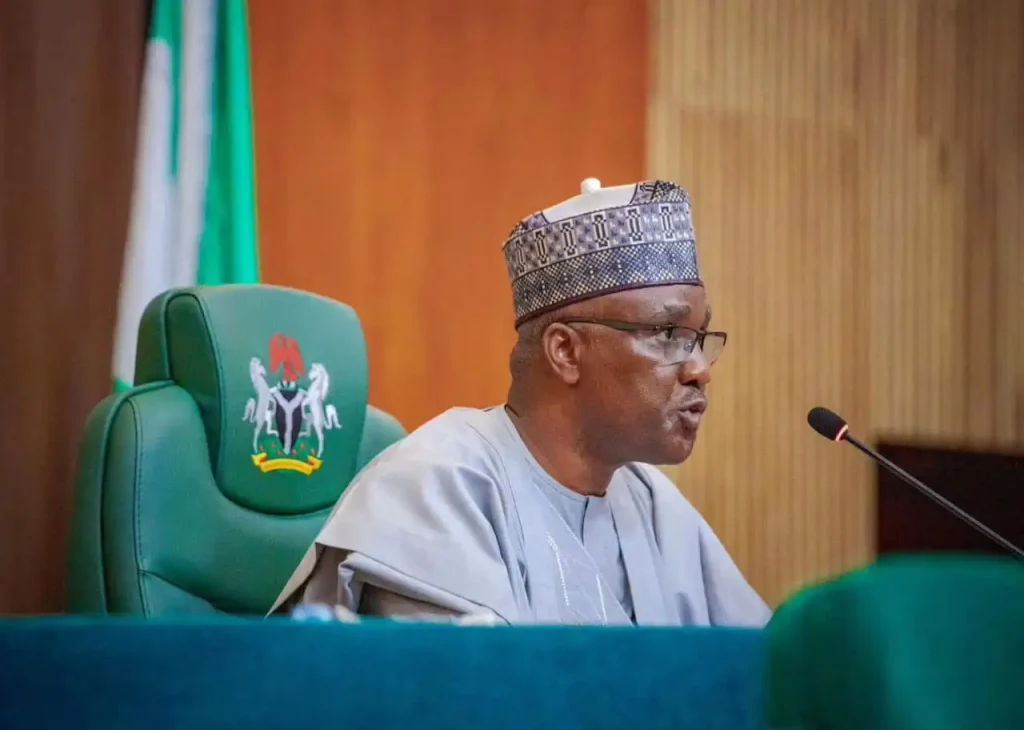

The Speaker of the House of Representatives, Abbas Tajudeen, raised the alarm at the 11th West African Association of Public Accounts Committees (WAAPAC) Conference in Abuja. Represented by House Leader Julius Ihonvbere, the Speaker cautioned that the sharp rise from ₦121.7 trillion in 2024 underscores a worrying trend in the nation’s borrowing practices.

According to him, Nigeria’s debt-to-GDP ratio has now reached 52 percent, significantly breaching the statutory ceiling of 40 percent. He warned that unless urgent reforms are implemented, future generations could inherit unsustainable liabilities that cripple development.

“Major borrowing proposals should be subject to public hearings, and simplified debt reports must be made available to the general public. Oversight is most effective when it is not only parliamentary but also people-driven,” Mr. Tajudeen said.

The Speaker placed Nigeria’s debt troubles within Africa’s wider fiscal crisis. By 2022, Africa’s public debt stood at $1.8 trillion, with external borrowing expected to surpass $1 trillion by 2023.

Countries like Sudan (344% debt-to-GDP), Ghana (84%), and Kenya (70%) are already in dangerous fiscal territories, spending more on debt servicing than on critical sectors such as healthcare and education. Tajudeen stressed that Africa’s reliance on private lenders and high-cost commercial loans leaves economies vulnerable to global shocks and interest rate hikes.

To tackle the crisis, the Speaker proposed the creation of a West African Parliamentary Debt Oversight Framework under WAAPAC. This, he said, would harmonize debt reporting across the sub-region, enforce transparency, and strengthen the bargaining power of African parliaments in international finance.

He also revealed plans to establish a capacity-building program for Public Accounts and Finance Committees, equipping lawmakers with tools for debt sustainability analysis, fiscal risk assessment, and oversight of complex financial instruments. PAC’s Revenue Recovery

In a related development, the Chairman of the Public Accounts Committee (PAC), Bamidele Salam, announced that the House had successfully recovered over ₦200 billion in lost revenue for the federal government in the past year.

The recovered funds, according to him, followed extensive investigations into ministries, departments, and agencies (MDAs). He said the intervention helped block leakages, reinforce compliance with financial rules, and restore public confidence in legislative oversight.

Analysts argue that while debt can serve as a tool for growth if invested wisely in infrastructure, education, and job creation, Nigeria’s rising borrowing trend risks fueling consumption and corruption instead.

With debt servicing already consuming a significant portion of national revenues, many fear that social spending on health, education, and development could shrink further—unless parliament and citizens alike demand greater accountability.

Fiscal Responsibility